Stay connected with your money

Take care of your finances whenever, wherever, however you want.

Benefits You'll Love

- 24/7, anywhere access to accounts

- Pay bills, check statements, send cash, and more

- User friendly mobile app

Free, secure, and easy-to-use service for Keystone Bank customers. Manage a number of banking activities anytime, anywhere from online banking or the mobile app:

- View account balances and history

- Transfer funds between accounts (one-time and recurring transfers)

- Transfer funds between your Keystone Bank accounts and accounts at other U.S. financial institutions.

- View checks written and deposited

- Access electronic statements

- Make loan payments

- Switch your direct deposit automatically

- Monitor your credit report and score

- Set and manage account and debit card alerts

- Print or download account data for popular financial management software

- Use our online messaging to connect with a customer support specialist

Make more time for yourself and fewer bank trips with online bill pay.

- Pay one-time or recurring bills with ease

- Schedule payments in advance

- Set up payment reminders

- Ensure payments are received on time

- Have all payee information in one convenient place

- Retain funds until paper drafts are presented for payment

- Avoid paper clutter

- More secure than paper billing

- Print or download to popular financial management software

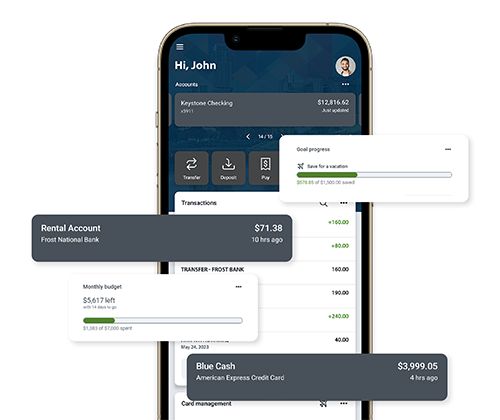

Fast, modern, and secure mobile app for customers enrolled in online banking¹

- Easily keep track of your finances — even on-the-go:

- View account balances

- Review history

- Transfer funds between accounts

- Receive alerts

- Pay bills

- Deposit checks

- Send money with Zelle®

- Automated direct deposit switch

- Monitor your credit report and score

- Available via any web-enabled cell phone or device

- Save valuable time and effort; avoid an extra trip to a branch

¹ Wireless carrier data rates may apply.

Introducing Zelle® — a fast, safe and easy way to send money in minutes¹ to friends, family and others you trust, right from the Keystone Bank mobile app. Zelle® makes it easy to send money to, or receive money from, people you trust with a bank account in the U.S. Find Zelle® in your Keystone Bank app.

FAST: Send money directly from your account to theirs — typically in minutes.¹

SAFE: Send or receive money right from your Keystone Bank app.

EASY: Send money to almost anyone you know and trust² using just an email address or U.S. mobile phone number.

¹ Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle®.

² Must have a bank account in the U.S. to use Zelle®.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Save paper and the environment with a fast, free, and easy alternative to paper statements.

- Easier and faster to retrieve

- Eliminate a paper trail

- Reduce chances of fraud and identity theft

- Simplify recordkeeping

- Easily access past statements

- Ability to download for permanent storage or print if needed

- Receive email notice when new statement is ready

We put security tools in your hands.

- Our biometric technology to create a more secure, more convenient way to access all your banking needs on the go.

- Setup real-time transaction alerts right from your phone

- Notify us of travel alerts within the mobile app

- Take full control of your debit card — right from your phone.

- Turn your card on and off if it’s lost, stolen or being misused

- Get instant alerts when your card is used

- Set dollar limits to keep spending in check

- Prevent transactions that don’t match your settings

EASY DIRECT DEPOSIT SWITCH

With Keystone Bank's automated direct deposit switch, you can now redirect your direct deposit to your Keystone Bank account right from your phone or digital banking. No need to go to your HR department, no need for papers, just you in control of your money - the way it should be.

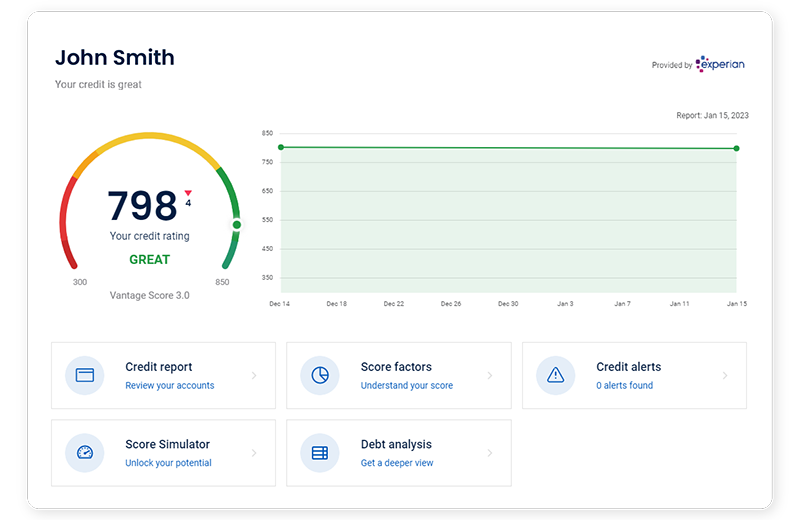

CREDIT REPORT AND MONITORING

Safeguarding your personal credit is crucial. Whether you are applying for credit through a loan or with a credit card, regular monitoring can prevent issues.

My Credit is a FREE credit monitoring tool that helps you stay in control of your credit score and history with personalized information and educational tools accessible through our online and mobile banking.

My Credit allows you to:

- See your up-to-date score and score history using a visual score tracker

- View a complete credit report, including all payment history

- See open balances and calculate your debt-to-income ratio

- See what factors impact credit and how your activity is evaluated and ranked

- Learn about managing your credit score and understand how it is determined

- Use the Score Simulator to explore how changing your credit information could affect your score

INSIGHTS

Keystone Bank has joined forces with Mastercard® Finicity, a leading global financial technology company, to bring you a powerful account aggregation solution!

- Streamlined Account Aggregation: Our partnership enables seamless and secure aggregation of your financial accounts in one central location – your Keystone Digital Banking. By connecting all your bank accounts, credit cards, loans, and investments, you can effortlessly gain a complete and up-to-date view of your financial landscape.

- Daily Data Updates: Stay informed and in control with daily updates on your financial transactions. Our account aggregation solution ensures that you have the latest information at your fingertips, empowering you to make informed decisions about your money.

- Simplified Budgeting and Planning with our new Insights tool: Take charge of your budgeting and financial planning with ease. Our Insights solution offers powerful budgeting tools, allowing you to set and track your financial goals effortlessly. By having a holistic view of your income, expenses, and savings, you can create realistic budgets, track your progress, and make adjustments as needed.

- Bank-Level Security: We understand that security is of utmost importance when it comes to your financial data. Rest assured that our partnership with Mastercard Finicity ensures robust security measures, utilizing state-of-the-art encryption and industry best practices to protect your information. Your data privacy and security are our top priorities.

To begin linking your external accounts, simply login to digital banking from our website or mobile app. Navigate to “Accounts” on the left navigation pane, choose “Link an account” (“+” icon on mobile) and follow the prompts. Insights is also readily available via our left navigation.

Insights Guide

Use this calculator to determine your projected earnings from our Keystone Rewards Checking account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly interest earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Keystone Rewards Checking*

| Tier | Interest Rate | Annual Percentage Yield |

|---|---|---|

| 0 - $50,000 | 5.37% | 5.50% |

| $50,000+ | 0.50% | 2.17% to 5.50% |

| Qualifications not met | 0.05% | 0.05% |

Qualifications

Earning your rewards is as simple as using the free services that come with your account. Enrollments must be in place and all of the following transactions and activities must post and settle to your Keystone Rewards Checking® account during each Monthly Qualification Cycle:

- At least 1 ACH credit or ACH payment transaction

- At least 12 debit card purchases, each greater than $3.49

And if you don’t meet your qualifications during a cycle, your free account will still earn our base rate. Then you can get back to earning your full rewards the very next month.

Keystone Rewards Savings*

| Tier | Interest Rate | APY |

|---|---|---|

| 0 - $100,000 | 4.65% | 4.75% |

| $100,000+ | 0.50% | 2.63% to 4.75% |

| Qualifications not met | 0.05% | 0.05% |

Qualifications

Qualifying for your Keystone Rewards Checking or Keystone Cash Back Checking® rewards automatically qualifies you for the highest Keystone Rewards Savings® rate, too. Enrollments must be in place and all of the following transactions and activities must post and settle to your Keystone Rewards Checking or Keystone Cash Back Checking account during each Monthly Qualification Cycle:

- At least 1 ACH credit or ACH payment transaction

- At least 12 debit card purchases, each greater than $3.49

It's no problem if you miss a qualification cycle. Both accounts are still free and earn our base interest rate. And you can get back to earning rewards the very next month you qualify.

No Penalty CDs

| Term | Interest Rate | APY |

|---|---|---|

| 13 months | 0.35% | 0.35% |